How to Buy Affordable and High-Value Life Insurance in the U.S.

Life insurance provides crucial financial protection for your loved ones, ensuring they’re not burdened with expenses after your passing. Many top U.S. insurers, such as State Farm, Allstate, Progressive, and Nationwide, offer affordable plans, with coverage amounts like $250000 Life Insurance for $15/Month. By exploring options from these trusted companies, you can find a policy that fits your budget and provides peace of mind.Search for "How to save money on life insurance"

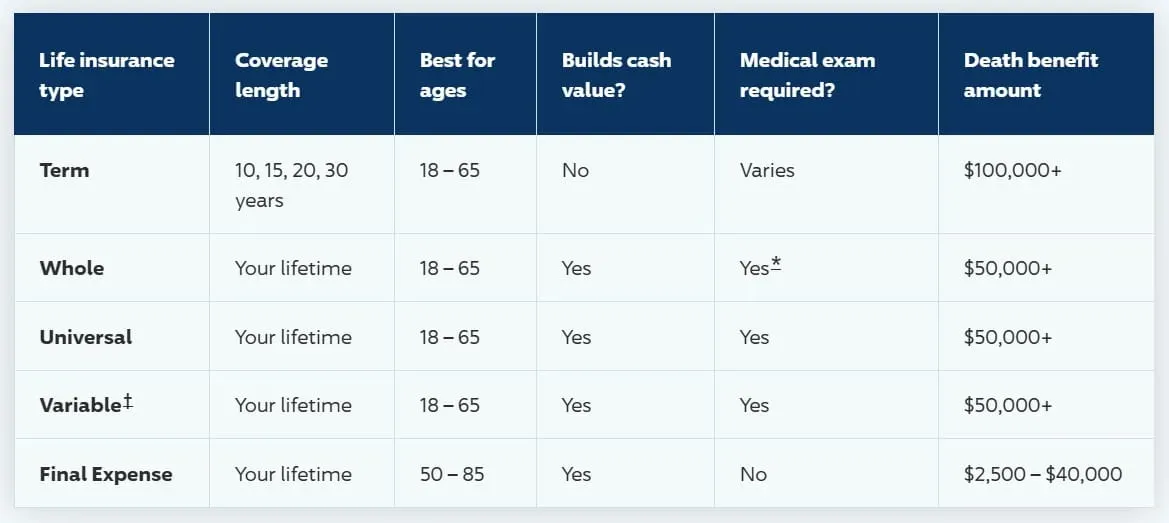

Compare the different types of life insurance

Before purchasing life insurance, it's important to understand the basic types available:

- Term Life Insurance: Provides coverage for a specific period, typically 10, 20, or 30 years. Premiums are relatively low, making it suitable for those on a budget.

- Whole Life Insurance: Offers lifelong coverage with a cash value accumulation feature. Premiums are higher but ideal for long-term financial planning.

- Universal Life Insurance: Combines features of term and whole life insurance, offering flexible premium payments and coverage periods.

Find More Ablout "How to Choose Life Insurance Type"

To illustrate how everyday Americans navigate life insurance, here are three relatable scenarios:

- Case Study 1: The Young Professional

Sarah, 28, Non-Smoker, No Health Issues

Sarah wanted coverage to protect her student loans and future family. She opted for a 20-year term life policy with a 500,000 deathbenefit.BycomparingquotesonSafeButler’splatform,shelockedinarateof $22/month—cheaper than her gym membership!

Key Takeaway: Young, healthy individuals save big with term life insurance - Case Study 2: The Mid-Career Parent

Mike, 45, Former Smoker, Managing Hypertension

Mike worried his health history would spike costs. After quitting smoking for two years and improving his blood pressure, he qualified for a universal life policy at $85/month—40% cheaper than initial quotes. His secret? A thorough medical exam and transparency with insurers - Case Study 3: The Retiree-Bound Couple

Linda and Tom, 60, Planning Retirement

This duo prioritized legacy planning. They chose a joint survivorship policy from Nationwide, which covers both under one premium ($150/month). By bundling with their existing home insurance, they saved 15%.

Find More Ablout "Life Insurance for Seniors Over 60"

5 Steps to Affordable Life Insurance

Follow these strategies to maximize value without breaking the bank:

- Choose the Right Policy Type

Term Life Insurance: Ideal for temporary needs (e.g., covering a mortgage). Average cost: 30–50/month for a 35-year-old17.

Whole/Universal Life: Better for lifelong coverage and cash value growth but pricier (e.g., 100–300/month)17. - Compare, Compare, Compare

Use online platforms like SafeButler or TheLifeTank.com to compare quotes from top insurers like State Farm, Prudential, and New York Life. Even small differences in premiums add up over time1517. - Leverage Health and Lifestyle

Non-smokers save up to 3x more than smokers. Regular exercise and managing chronic conditions (e.g., diabetes) can also lower rates17. - Bundle Policies for Discounts

Combining life insurance with auto or home insurance often unlocks discounts. For example, Nationwide offers shared coverage plans for couples317. - Buy Early

Premiums jump with age. A 30-year-old might pay 25/month,whilea50−year−oldcouldpay 150/month for the same coverage17

Search For "$250000 life insurance policy"

Price Factors: What Determines Your Premium?

- Age: Rates double every decade after 40

- Health: Insurers review BMI, blood pressure, and family history. A clean bill of health = savings

- Lifestyle: High-risk hobbies (e.g., skydiving) or dangerous jobs (e.g., construction) increase costs

- Lifestyle: High-risk hobbies (e.g., skydiving) or dangerous jobs (e.g., construction) increase costs

More about "Cheap Life Insurance for Seniors"

Where to Buy: Top Insurers and Direct Links

Nationwide: Nationwide offers term life, whole life, and universal life insurance, providing flexible coverage options with cash value growth for permanent policies. Their term life plans are affordable and ideal for short-term needs.

State Farm: State Farm provides term, whole, and universal life insurance, known for its strong customer service and customizable policy options. Their policies can include riders for added flexibility.

SafeButler:SafeButler is an insurance comparison platform, helping users find the best life insurance policies from various providers. It simplifies the shopping process by offering personalized recommendations.

Final Tips for Savvy Shoppers

- Negotiate: Ask agents about loyalty discounts or payment plans.

- Re-evaluate: Review your policy every 5 years—life changes, and so should your coverage.

- Avoid Over-Insuring: Calculate coverage based on debts, income, and future needs (e.g., college tuition)

Conclusion

Purchasing life insurance is a significant financial decision, and choosing the right product and insurer is crucial. By comparing quotes, selecting the appropriate type and term, maintaining good health, and considering online purchases, you can find affordable and high-value life insurance. We hope this guide and user case study provide valuable insights, helping you easily find the best life insurance for your needs.

Related Issues

Top Life Insurance Options for Affordable Coverage

Life insurance is a crucial safety net, offering essential financial security for your family and protecting them from financial hardship in the event of your passing. For example, you can secure affordable life insurance with high benefits, such as a $250,000 life insurance policy, for as little as $15 per month, making it accessible to many. By exploring different options and strategies, you can find a policy that provides the right coverage while saving money on life insurance, ensuring your loved ones are financially secure.

A Guide to Buying Homeowner’s Insurance

Your home is a significant investment, making homeowner's insurance essential for protection. If you're new to homeownership, navigating insurance options can feel overwhelming. Some reputable U.S. providers, like State Farm, Allstate, and Geico, offer a range of policies with average costs ranging from $700 to $1,500 per year, Some cheap home insurance starts at $50/Month,depending on your location and coverage needs. Here’s a quick guide to help you purchase homeowner’s insurance with confidence.

Transform Your Financial Planning Game with Top Life Insurance Quotes!

**Transform Your Financial Planning Game with Top Life Insurance Quotes!** Navigating the complexities of financial planning can be a daunting task, with myriad variables to consider. Among these, life insurance is a pivotal element that often doesn't receive the attention it warrants. Yet, unders